Wondering if you can borrow some money from Cash App? Yes, it’s possible to borrow money from your Cash App account and get a small loan if you’re eligible. Cash App offers a “Borrow” feature that allows eligible users to take out small loans directly through the app. Loan amounts typically range from $20 to $200 with a flat 5% fee and a 1.25% weekly interest rate. If you’re eligible, you’ll see the “Borrow” option on your Cash App home screen.

After selecting this option, you can review the loan terms and if you agree, provide some personal information and sign a repayment agreement. If approved, the money is instantly deposited into your Cash App account. However, not all users have access to this feature, as eligibility is based on factors like your Cash App usage and financial history. Remember to borrow responsibly and only take out loans you can comfortably repay.

Understanding Cash App Borrow

Cash App has made it quite straightforward for users to get a small loan. This section will walk you through what Cash App Borrow is, how the loan process works within the app, and the advantages of using this feature.

Borrowing Money on Cash App: Step-by-Step

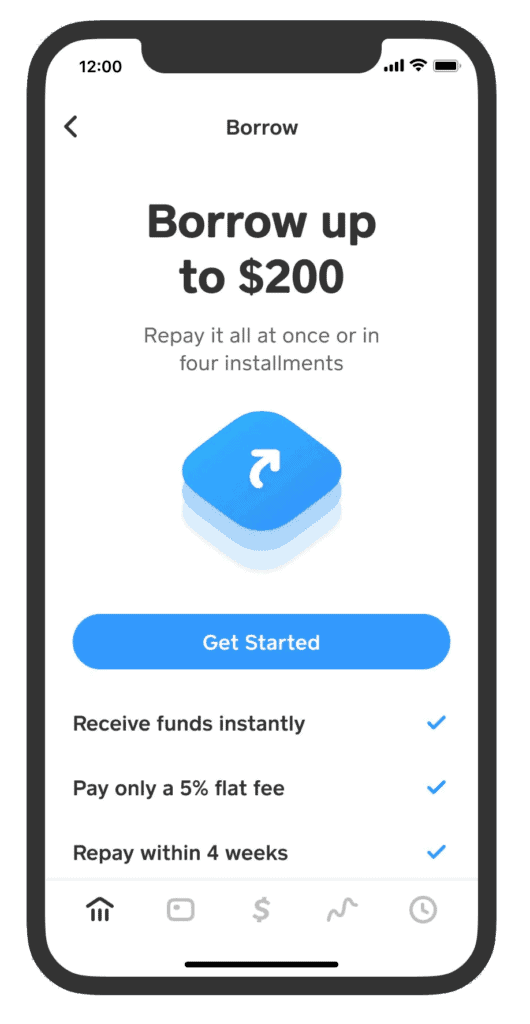

Cash App’s Borrow feature allows eligible users to access instant loans of up to $200. Here’s a breakdown of the process:

| Step | Action | Notes |

|---|---|---|

| Check Eligibility | Open Cash App and look for the “Borrow” option. If you see it, you’re eligible. Otherwise, the feature might not be rolled out to your account yet. | |

| Unlock Borrow | If you haven’t used Borrow before, tap “Borrow” and then “Unlock.” Cash App will ask for your consent to link your bank account and review your eligibility. | A successful verification unlocks the feature. |

| Select Loan Amount | Choose a loan amount between $20 and $200. The available amount depends on your Cash App activity and history. | Consider your ability to repay before selecting. |

| Choose Repayment Plan | Pick a repayment schedule that fits your budget. Options typically range from one to four weekly payments. | Each option displays the total repayment amount with fees. |

| Review and Accept | Carefully review the loan terms and fees before accepting. Once accepted, the funds are instantly deposited into your Cash App balance. | Remember, late payments incur additional fees. |

Additional Notes:

- Borrow has fees that vary based on the loan amount and repayment schedule. Be sure to understand the fees before committing.

- Repayments are automatically deducted from your linked bank account on your chosen schedule.

- Building a good repayment history can increase your borrowing limit over time.

- Borrow is intended for short-term needs and not long-term financial solutions. Use it responsibly and only if necessary.

What is Cash App Borrow?

Cash App Borrow is a loan feature that allows eligible users to borrow a certain amount of money through the Cash App. Typically, this amount ranges from $20 to $200. It’s designed as a short-term solution for users who need quick cash.

How Cash App Loans Work

To borrow money from Cash App, follow these steps:

- Open the Cash App on your smartphone.

- Tap on your account balance.

- Select the ‘Borrow‘ option.

- Choose how much you want to borrow and set your repayment option.

- Agree and accept the terms to receive the loan.

Please note that not all users have access to Cash App Borrow as it may still be considered a pilot program.

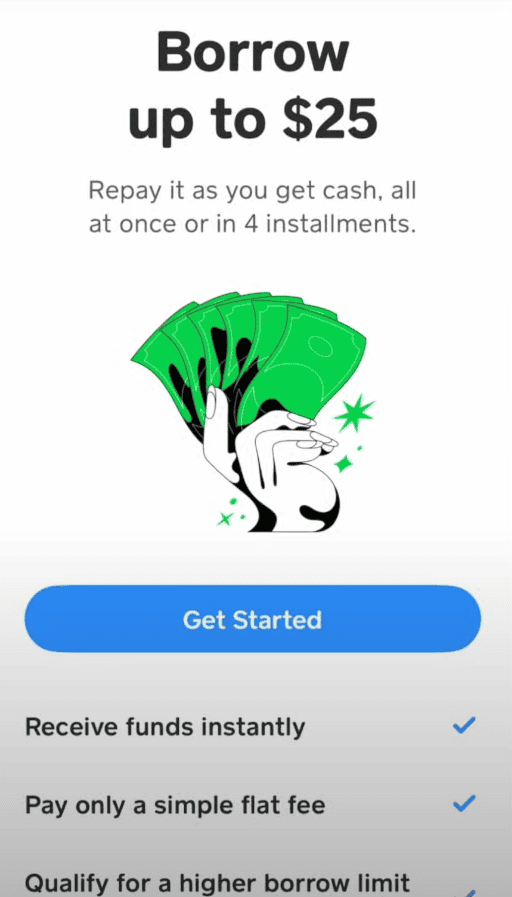

Benefits of Using Cash App for Loans

- Speed: The borrowed funds are generally available within minutes.

- Convenience: The application and borrowing process is conducted entirely within the app.

- Clarity: The terms, such as the 5% flat fee for borrowing, are spelled out clearly to avoid confusion.

Eligibility and Requirements

Borrowing money through Cash App requires meeting certain criteria that ensure the service is being used responsibly. These requirements revolve around credit score, account usage, and banking details.

Credit Score Implications

Credit score plays a role in borrowing options, including those through digital payment platforms. Although Cash App has not publicly disclosed the exact credit score requirements, one’s credit history could influence their eligibility to access the Cash App Borrow feature.

Cash App Use and History

Consistent and positive usage history within the Cash App ecosystem can be beneficial. Users typically need to demonstrate regular activity, which might include frequent transactions, to show they’re active members of the platform. The company might consider these factors when determining a user’s qualification for a loan.

Banking and Direct Deposit Requirements

To be eligible for Cash App’s borrowing feature, users often need a linked bank account with a history of direct deposits. Regular income deposits into one’s Cash App account can serve as an assurance of repayment capacity, thus potentially affecting eligibility.

Loan Terms and Conditions

When considering a loan through Cash App, it’s critical to fully comprehend the terms and conditions. These include how much money you can borrow, how you’ll need to repay it, and the costs involved.

Understanding Loan Amounts

Cash App may offer a loan if you’re a regular user who meets certain criteria. The loan amounts are typically modest, commonly up to $200. It’s designed to assist Cash App customers with short-term cash needs.

Repayment Terms

The repayment of a Cash App loan is straightforward but must be taken seriously. You will agree to a structured repayment plan, where the due date and amounts are defined. Missing a repayment can lead to additional charges.

Interest Rates and Fees

Cash App applies a 5% flat fee for borrowing money which is added to the loan. Additionally, they may carry an annual percentage rate (APR) typical of short-term loans. This APR is the cost you’ll pay each year to borrow money, including both the interest rate and additional fees.

Application Process

When it comes to borrowing money from Cash App, the process is straightforward. Users with access to the borrow feature can request a loan, review the terms, and receive funds.

How to Request a Loan

To start the loan application process, open the Cash App on your device. Within the app, navigate to the banking tab or home screen to find the Borrow option.

- Step 1: Tap the Borrow feature.

- Step 2: Choose a loan amount that fits your needs.

Please note that not all users will have the Borrow option, as it’s dependent on eligibility.

Review and Acceptance of Terms

Once the desired loan amount is selected, it’s essential to read the details of the loan agreement carefully.

- Review: Look over the repayment schedule, interest rates, and other terms provided.

- Agree: If the terms are satisfactory, accept the agreement to proceed.

It’s imperative to thoroughly understand the terms to ensure that you can comply with the repayment requirements.

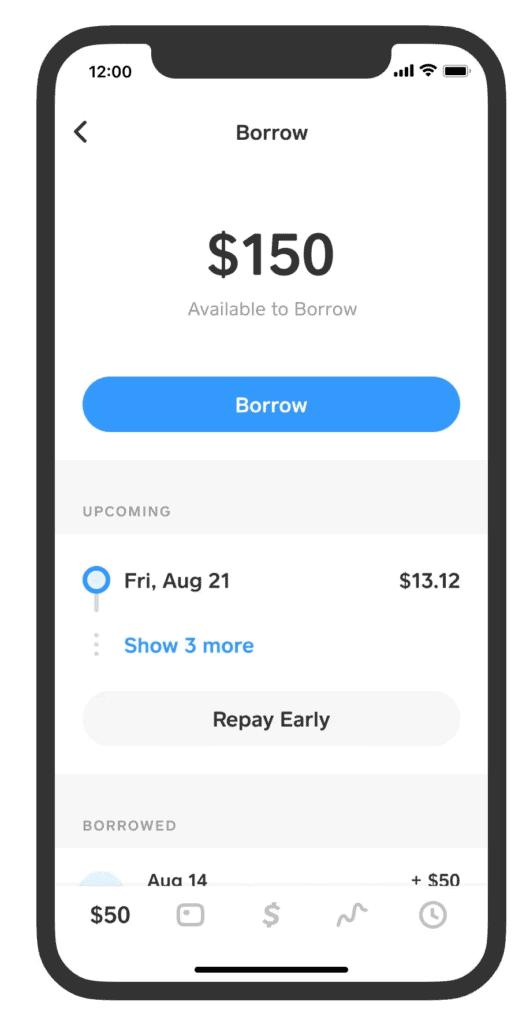

Receiving the Loan Amount

After accepting the loan terms, Cash App typically disburses the loan amount promptly to your Cash App balance.

- Disbursement: Funds are deposited into your account, making them readily available for use.

- Accessibility: The loan amount can be used just like any other funds on the platform.

The entire borrowing process from requesting to receiving funds is designed to be quick and user-friendly, keeping in line with Cash App’s goal of providing efficient financial services.

Repayment and Late Fees

Borrowing money through Cash App comes with certain responsibilities, namely adhering to a repayment schedule and understanding the impact of late payments.

Setting Up Repayment

When you take out a loan from Cash App, you need to set up your repayment plan. This simply means deciding how you’ll pay back what you’ve borrowed. You’ll choose an amount to repay and a schedule. It’s vital to follow through with these payments to avoid additional costs.

Consequences of Missed Payments

If you miss a payment, it can be more than just a small hiccup. Not sticking to the agreed repayment plan can lead to extra charges, and it may even affect your credit score over time. It’s key to make each payment on time to keep your account in good standing.

Grace Period and Late Fees

Cash App may offer a grace period, which is extra time to make your payment without being hit with a late fee. However, if you go beyond this period without making a payment, expect to be charged an extra 1.25% on your remaining balance for every week you’re late. Keep an eye on those dates to avoid these fees.

Alternative Borrowing Options

When borrowing from Cash App isn’t available, exploring other avenues can be crucial. The following subsections cover three mainstream methods that provide access to emergency funds or manage short-term financial gaps.

Cash Advance Apps

Cash advance applications offer an immediate remedy for quick cash needs. These apps usually provide small, short-term loans and sometimes require proof of consistent income. Some popular cash advance apps include Earnin, which allows users to access funds they’ve already earned but haven’t yet received, and Dave, designed to help avoid overdraft fees by providing small cash advances.

Personal Loans

A personal loan from a bank or online lender is suited for larger amounts of money or longer repayment periods. They often require a credit check and come with varying interest rates. Pros of personal loans include structured repayment plans and potentially lower interest rates compared to credit cards. Cons include the necessity of a good credit score for better terms and potential fees.

Credit Card Advances

Credit card companies allow cardholders to take a cash advance, which is effectively borrowing against the card’s line of credit. This option can be quick but often comes with high interest rates and additional fees. It’s essential to understand the terms, as credit card advances can become expensive if the balance isn’t paid promptly.

Each option possesses unique benefits and considerations. Borrowers should assess their financial situation and choose the most suitable path for their needs.

Security and Privacy

When considering borrowing from Cash App, it’s important to understand the measures in place to protect your financial data and privacy. Cash App prioritizes security with robust encryption and adherence to compliance standards, while users should be vigilant about loan scams.

Cash App Encryption

Cash App employs encryption to safeguard your personal and financial information. This encryption acts like a digital lock and key, ensuring that all data transferred within the app can only be accessed by authorized parties. Whether you’re requesting a loan or checking your balance, encryption keeps your transactions secure.

Data Security Standards

The platform is PCI Data Security Standard Level 1 compliant, which is the highest level of certification in the payments industry. This means that Cash App meets stringent requirements for securing and handling cardholder data, offering users peace of mind that their sensitive information is handled with utmost care.

Avoiding Loan Scams

Be cautious of loan scams—con artists often lure borrowers with the promise of easy money. Always confirm loan transactions within the Cash App, and never send a “confirmation” payment or share a PIN with anyone. Remember, Cash App will ask you to confirm new payments to non-contacts and will alert you to important account changes, combating fraudulent activities before they can occur.

Frequently Asked Questions

Securing a loan through Cash App is subject to specific eligibility criteria and understanding the process is key to accessing funds when you need them.

What steps are needed to unlock the borrow feature on Cash App?

Users must look for the ‘Borrow’ option within their Cash App wallet. If available, this feature requires them to follow the app’s instructions to initiate a loan request. Availability is limited as the program is in a pilot stage.

Is it possible to get a loan through Sutton Bank for Cash App users?

Sutton Bank issues the Cash Card for Cash App but the bank does not facilitate loans through Cash App. The borrowing feature is entirely managed by Cash App itself.

What is the process for borrowing money on Cash App using an iPhone?

iPhone users can access the ‘Borrow’ feature by tapping on their Cash App balance, then selecting ‘Borrow’ if it’s available, and following the prompts to take out a loan.

How can I instantly receive a loan from Cash App?

Instant loans depend on eligibility within the app. Users who have access to Cash App Borrow can quickly request funds and, if approved, receive them almost instantly.

How long after making a payment on Cash App can I request to borrow money again?

Re-borrowing terms vary based on user repayment history and Cash App’s lending policies. Users typically must settle their current loan before accessing a new one.

Are there alternative apps that offer a $200 loan similar to Cash App?

There are other lending services and apps offering small, short-term loans similar to Cash App Borrow. Each service has its own set of terms and conditions, and users must review them carefully before borrowing.