Technology

New Taiwan Law Blocks TSMC From Giving Advanced Chip Tech To U.S.

Taiwan has enacted a strategic new law that effectively bars its crown jewel, TSMC (Taiwan Semiconductor Manufacturing Company), from exporting ...

5 Free Antivirus Programs To Eliminate Malware and Viruses (2025)

You don’t need to pay for peace of mind when it comes to malware protection. In 2025, several free antivirus ...

Apple Watch Ultra 3 Is Expected To Launch in September 2025

Apple is preparing to push its premium smartwatch line even further with the highly anticipated Apple Watch Ultra 3, expected ...

How To Access Your Router Settings To Update & Make Changes

Accessing your router settings can sometimes feel like a challenge, but it’s actually quite simple once you know the right ...

NVIDIA Reportedly Prepping RTX 5080 Super With 24GB GDDR7 Memory

NVIDIA may be preparing to unleash another wave of RTX 50-series graphics cards with more memory and higher specs. According ...

IRQL NOT LESS OR EQUAL: Fixing This BSOD Windows Error

Seeing the dreaded blue screen with the “IRQL_NOT_LESS_OR_EQUAL” error can ruin anyone’s day. This common Windows stop code typically appears ...

The Best iPad Cases for Kids (2025)

iPads have become an essential tool for kids today, blending education, creativity, and entertainment into one sleek device. But as ...

Windows Has Stopped This Device Because It Has Reported Problems (Code 43)

Have you ever tried to use a device on your computer only to encounter the frustrating error message “Windows has ...

Cakewalk by BandLab Is Our Pick As The Best Free Music Making Software

Creating professional-quality music no longer requires a hefty investment, which is a great thing. Whether you’re a budding songwriter, a ...

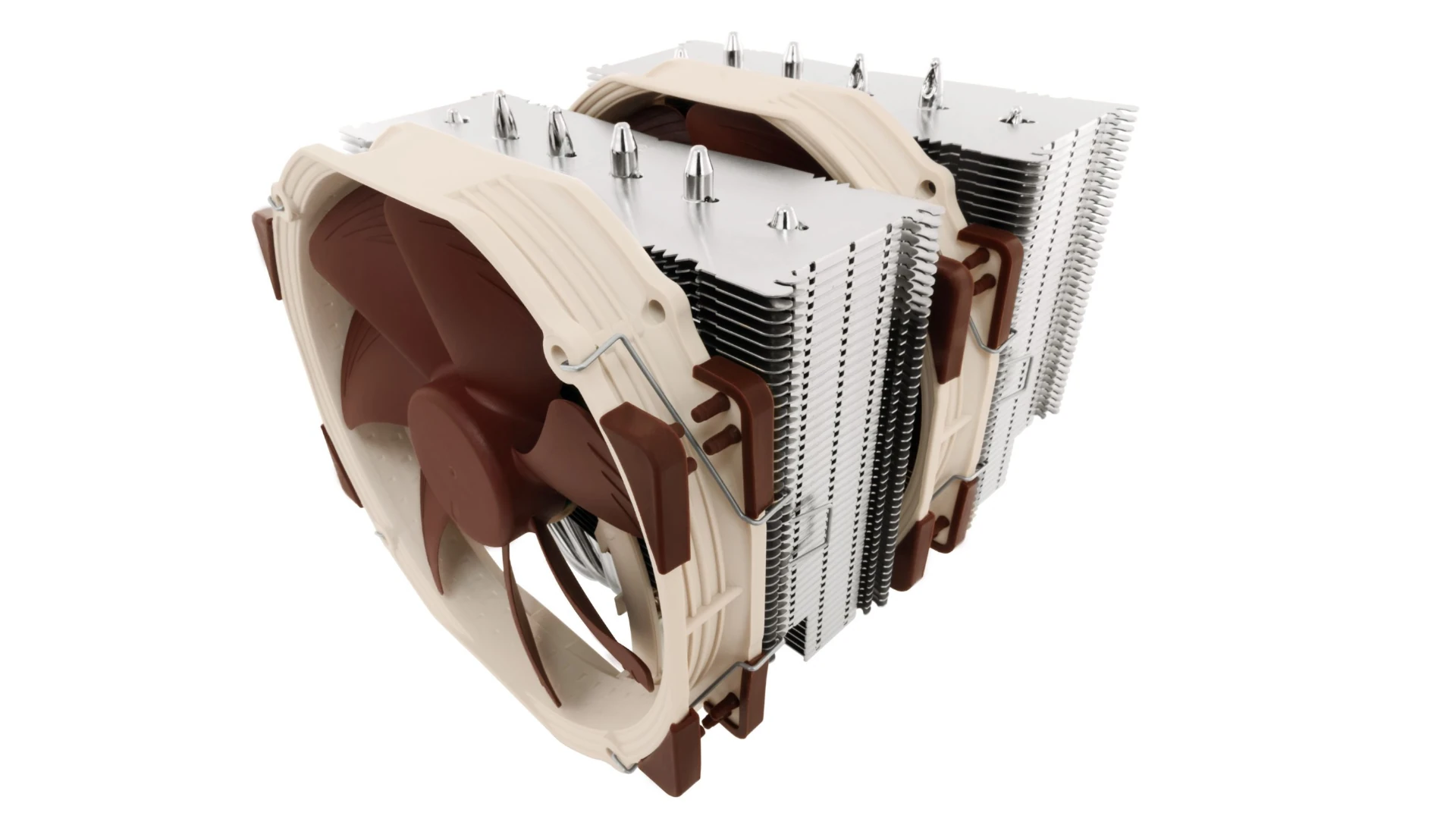

The Noctua NH-D15 CPU Cooler: Still the Gold Standard After All These Years

When it comes to air cooling for CPUs, few names have commanded as much respect as the Noctua NH-D15. Since ...