Venmo is a great way to securely and quickly send money directly from your bank account. However, Venmo’s terms of service prohibit having multiple accounts for a single user. You are allowed to have one personal account and attach your business to it, but opening two separate accounts is against the rules. Venmo will flag and lock both accounts if you try to do so.

There are a few exceptions for those with joint bank accounts, shared debit cards, or business needs, but generally, the one person/one account rule is enforced. If you absolutely need to set up a second Venmo account, you’ll need to use a second email address and phone number. Understanding these exceptions and Venmo’s reasoning behind this policy can help you use the platform effectively and ensure smooth and secure transactions.

One Person, Multiple Venmo Accounts?

Venmo’s Policy on Multiple Accounts

Venmo’s rules generally don’t allow one person to have multiple personal accounts. This is to prevent fraud and keep the platform secure for everyone. However, there are a few exceptions to this rule.

When Multiple Accounts Are Allowed

You might be able to have more than one Venmo account if:

- You have a joint bank account: If you share a bank account with someone, like a spouse or family member, you can both have separate Venmo accounts linked to that same account.

- You share a debit card: Similar to a joint bank account, if you share a debit card with another person, you may each be allowed to have your own Venmo account.

- You need a business account: If you’re a business owner, you can create a separate Venmo account specifically for your business transactions. This helps keep your personal and business finances separate.

Why Venmo Limits Accounts

Venmo has good reasons for limiting multiple accounts. It helps to:

- Prevent fraud: Multiple accounts can be used to scam people or launder money.

- Simplify transactions: Having one account per person makes it easier to track payments and keep things organized.

- Protect users: It helps Venmo verify users and ensure everyone is who they say they are.

What if You Need Another Account?

If you think you have a legitimate need for another Venmo account, you can contact Venmo support and explain your situation. They may be able to make an exception for you.

Table: Reasons for Multiple Venmo Accounts

| Reason | Allowed? |

|---|---|

| Personal use with separate bank accounts/cards | No |

| Shared bank account with another user | Yes |

| Shared debit card with another user | Yes |

| Business use | Yes |

Key Takeaways

- Users can have two Venmo accounts with unique contact details

- Each account needs a separate email and phone number

- Multiple accounts can be linked to the same bank

Setting Up Your Venmo Account

Venmo is a popular money transfer app that lets you send and receive funds. You can create a personal or business account and link your bank or card.

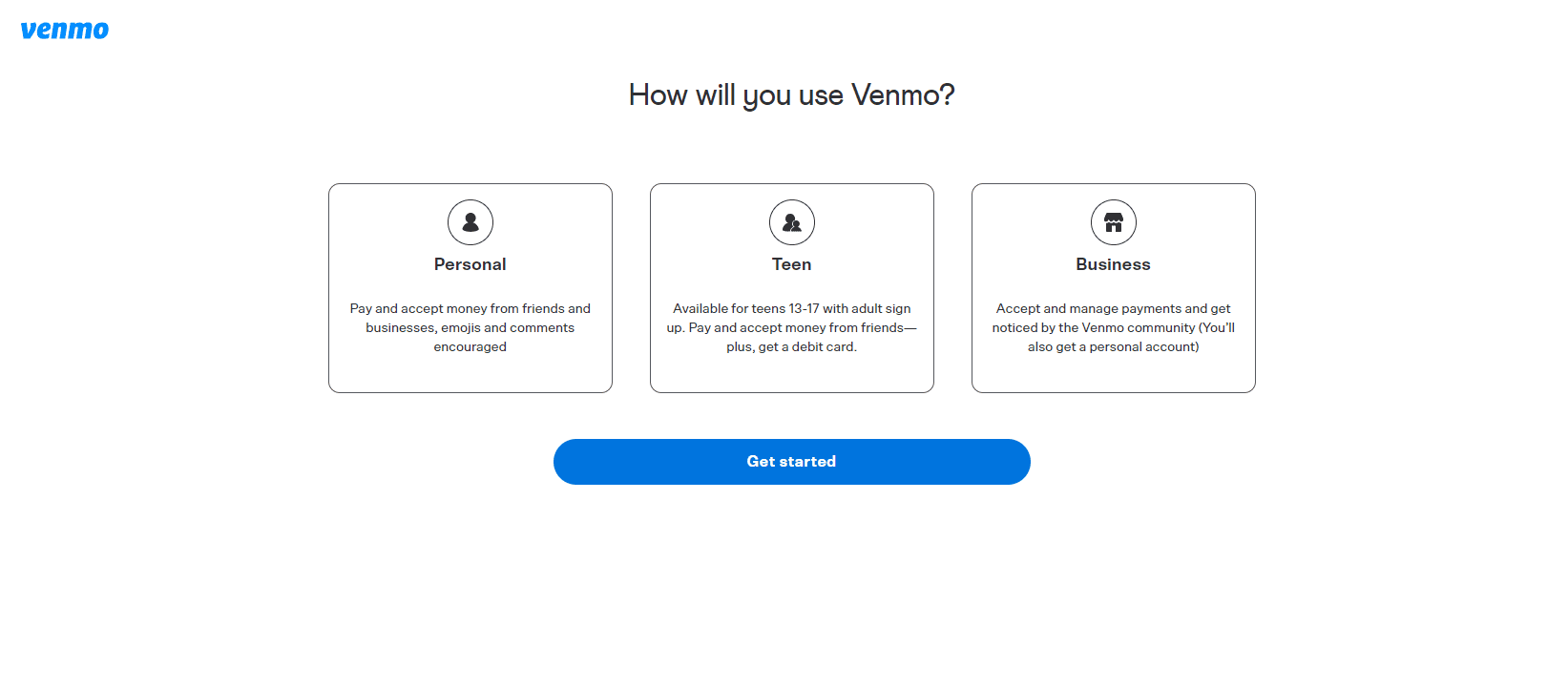

Creating a Personal Venmo Account

To set up a personal Venmo account:

- Download the Venmo app from your device’s app store

- Open the app and tap “Sign Up”

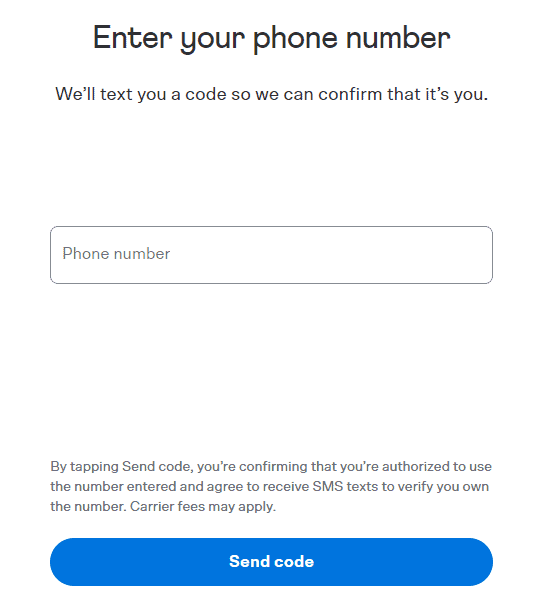

- Choose to sign up with your phone number or email

- Enter your name and create a password

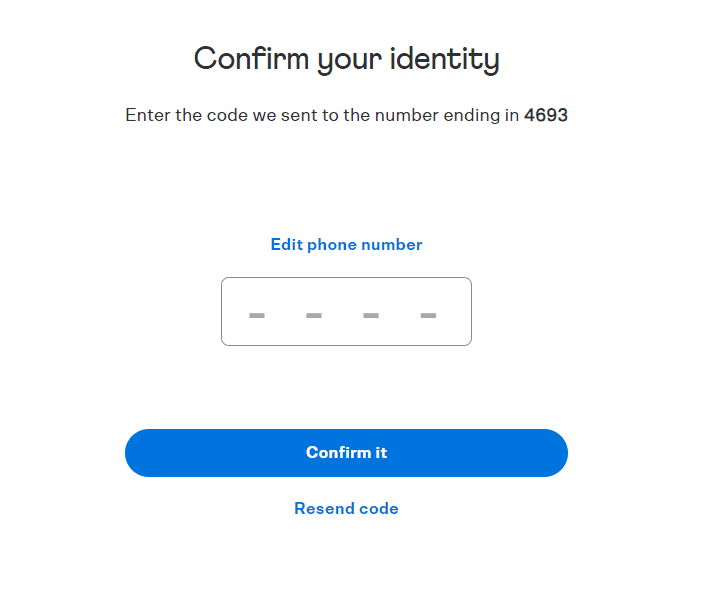

- Verify your phone number or email

- Set up your profile and privacy settings

You can only have one personal account per phone number and email. Make sure to use a strong, unique password to keep your account safe.

Establishing a Venmo Business Account

For business owners, Venmo offers special accounts:

- Go to the Venmo website and click “Get Business Profile”

- Sign in to your personal account or create a new one

- Enter your business info (name, address, tax ID)

- Choose your business type and category

- Set up your business profile and payment options

Business accounts let you accept payments and offer features like itemized receipts. They’re great for small businesses and freelancers.

Adding Bank and Card Information

To use Venmo, you need to link a funding source:

- Open the Venmo app and tap the menu icon

- Go to “Settings” then “Payment Methods”

- Select “Add a bank or card”

- Choose bank account or debit/credit card

- Enter your bank or card details

- Verify the account if needed

You can add multiple funding sources to your Venmo account. This gives you more options when sending or receiving money.

Understanding Venmo Account Restrictions

Venmo has rules about setting up and using accounts. These rules aim to keep users safe and prevent misuse of the app.

Managing Multiple Accounts

Users can have two Venmo accounts, but each must have its own email and phone number. This helps keep accounts separate and secure. To set up a second account:

- Open the Venmo app

- Tap the menu icon

- Go to Settings

- Choose “Add a new account”

- Enter a new email and phone number

Remember, you can’t use the same phone number for both accounts. This rule stops people from making too many accounts.

Security Protocols and Unauthorized Access Prevention

Venmo uses strong security to protect users. Some key safety features are:

- Two-factor authentication

- PIN codes for the app

- Encryption for personal and financial data

These measures help stop unauthorized access. If Venmo spots strange activity, they might lock the account. To unlock it, users often need to prove their identity.

Account Limitations and Phone Number Restrictions

Venmo limits what users can do to keep everyone safe. Some key limits are:

- Weekly sending limit of $4,999.99

- Only one phone number per account

- No international transfers

The phone number rule is strict. If you try to use the same number for two accounts, Venmo might suspend one or both. This helps prevent fraud and keeps the platform secure for all users.

Handling Money Transactions on Venmo

Venmo lets users send and get money easily. It works for small payments between friends or bigger ones for bills. The app links to bank accounts and cards to move funds.

Sending and Receiving Money

To send money on Venmo, pick a contact and enter the amount. Add a note about what it’s for. Tap “Pay” and the money goes through right away. Getting money is just as simple. When someone sends you cash, you’ll get a notice. The money shows up in your Venmo balance.

You can use your Venmo balance to pay others. Or you can move it to your bank account. For quick transfers, link a debit card. This lets you get your money in minutes.

Venmo works best for paying friends back. But some stores take Venmo too. Look for the Venmo option when you check out online or in apps.

Understanding Fees and Transaction Limits

Most Venmo transfers are free. Sending from your Venmo balance or bank account costs nothing. Using a credit card has a 3% fee.

Getting money is always free. But moving it to your bank can cost money if you want it fast. The standard transfer is free but takes 1-3 days. Instant transfer to a bank or debit card costs 1.75% of the amount.

Venmo has limits on how much you can send. New users can send up to $299.99 per week. After you prove who you are, this goes up. The max is $60,000 per week for one user.

There’s also a limit on how much you can pay in stores. It’s $6,999.99 per week.

Linking Bank Accounts and Debit Cards for Payments

To use Venmo, you need to link a funding source. This can be a bank account, debit card, or credit card. Adding a bank account is free and easy. Just pick your bank from the list in the app. Then log in with your bank details.

Debit cards are faster for getting money out of Venmo. To add one, enter the card number, expiry date, and security code. Venmo checks the card to make sure it’s yours.

You can have more than one funding source on your account. This gives you options when you pay. Pick the one you want to use for each payment.

For safety, Venmo checks new bank accounts and cards. This might take a day or two. After that, you’re all set to send and get money.